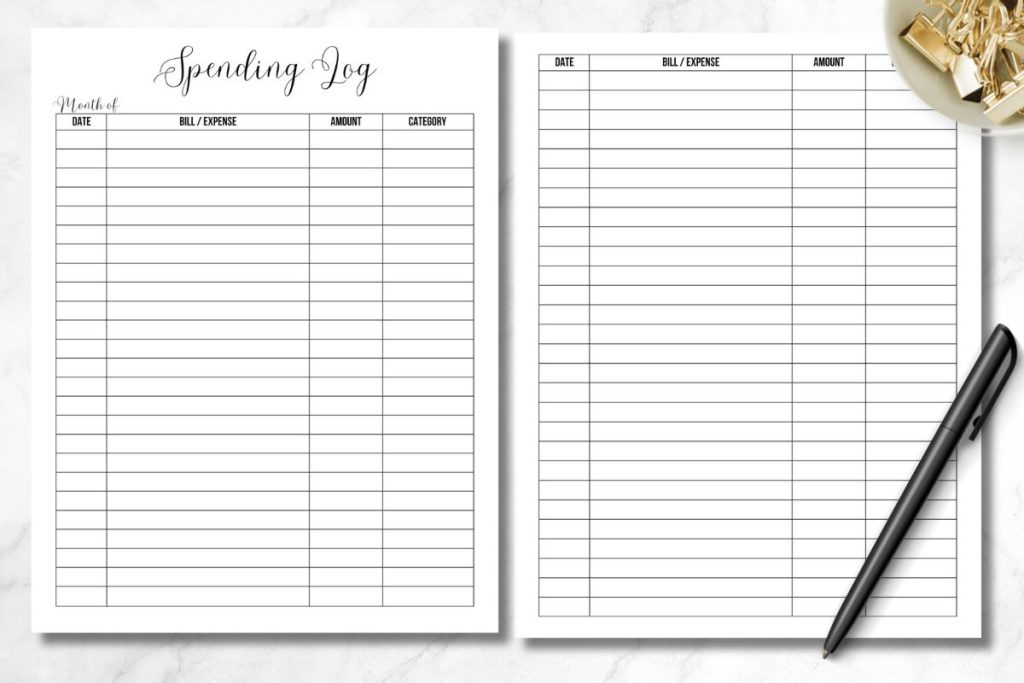

Free Budget Printables – Monthly Spending Log

Grab a free budget printable to keep track of your expenses and spending habits.

Whew – I have been working really hard to get my life back organized. Between adding a new little one to the family, homeschooling, and just everyday life, things have gotten a little out of sorts around here.

So, I decided to start putting together a binder full of different management printables to help me stay on track. It’s sort of a household management/budget binder all in one. And I’ve decided to offer all of the free budget templates and organizational tools here for you to use too.

Today’s free printable is a sort of monthly expense tracker that I’m calling a “Spending Log”. We will get in to how to use it here shortly, but first I wanted to mention these other printable budgeting worksheets I have. That way if you need to create your own monthly budget planner, you can do it for free!

Affiliate disclosure: This post may contain affiliate links. As an Amazon Associate this means I will earn a small commission if you choose to purchase through my links. This is at no extra cost to you! Read full disclosure here.

More Free Budgeting Printables for You

- Monthly Budget Sheet – A simplified monthly budget template that you can use again and again. Track your expected and actual income, as well as your budgeted expenses compared to what you actually end up spending.

- Bill Tracker – Keep track of your monthly bills, due dates, and payment amounts.

- Biweekly Paycheck Budget – If budgeting by check makes more sense for you, grab a free biweekly paycheck printable in this post.

Spending Log vs. Budget Worksheet

A spending log serves a different purpose than your budget in tracking your personal finances. But both of these resources are useful when it comes to getting better control of your financial situation.

A monthly budget gives a broad picture look at how much money you are planning to spend on different categories. You are setting up a budget to make sure you have enough money to cover your monthly expenses.

The spending log is meant to give valuable insights into your exact spending. You’ll track where, when and how much for every dollar.

You can see exactly where your hard-earned money is going.

How to Use a Spending Log

Using a daily spending log is pretty simple, it just takes a little time and routine.

The first step is making sure you’re taking a few minutes each day to jot down your spending. If you don’t have many transactions to log, you could possibly just do this at the end of the week.

Personally, I like to do this first thing in the morning. It’s the perfect time to get a good feel of my spending before I start the day. I’ll check my bank account and credit cards for the prior days transactions and log them.

I make note of the category each item falls into. These categories generally correspond with my budget categories. They include:

- Groceries

- Gas

- Fun Money

- Miscellaneous Spending

I don’t log my bills here, but you totally could if you prefer to track every item! Use some cute highlighters to color code your categories to make it easy to track.

If you’re following more of a cash only system, you’ll want to get those receipts out to jot down what you’ve been spending.

Then, at the end of the month, you’re going to need to add the amounts together based on categories. You can then go to your budget worksheet and see if your spendings for the entire month are in budget.

Benefits of a Spending Log

Knowing Your Finances

In order to meet financial goals, we have to be aware of our spending patterns. Using a spending log can help you see exactly how much money you’re spending on a monthly basis. This is a great way to see if there are certain areas you are overspending in.

Break Bad Spending Habits

You’ll also be able to identify certain spending habits you may have. If at the end of each month you notice trends in your spending that you’re unhappy with, you can start making better financial decisions going forward.

Being unaware of our bad habits is a definite way to never break them!

Make (and Stick to) a Good Budget

Having a way to track your monthly expenses and spending is a must when making personal budgets. By writing down your actual expenses, you’ll have realistic amounts to work with when setting up a budget. You’ll also know when you’re approaching the limits set in your budget. Without keeping track of your spending, you’re more likely to blow your budget.

Make Healthy Financial Habits

This goes hand in hand with the above benefit of breaking bad habits. Once you identify those not-so-great spending habits, you can begin to make healthy financial habits.

Get Your Free Download Here

This spending log is a 2-page printable. You can print the document front and back, or just use the front page. It is designed to print on US standard paper (8.5X11 inches).

Click here to download Free Spending Log

These printables are for personal use only and should not be used for commercial purposes.

Best wishes on your financial journey!