Monthly Bill Trackers You Need – Free Printable

Keep track of your bills and avoid late fees by using one of the free budgeting printables found in this post.

Today’s blog post isn’t particularly exciting considering it’s about bills. But I do hope that the free printable bill payment tracker that I’ve made makes it a bit better!

Keeping up with bills is just one of those things we have to do. It’s not necessarily hard – but it is another thing we have to keep track of. And I don’t know about you, but I feel like I’m pretty maxed out on things to keep up . My to-do lists are ever growing and there’s just no way to remember it all.

Which is why I think using a printable monthly bill payment log is such a good idea. Using a simple bill payment checklist will help you stay on top of your monthly bills. You can have all of your monthly payments listed in one place. And you’ll have peace of mind knowing that you’re not forgetting a bill or behind on paying it.

Be sure to grab the free printables at the bottom of the post. Happy Bill Paying! (I don’t think that’s actually a thing…)

Affiliate disclosure: This post may contain affiliate links. As an Amazon Associate this means I will earn a small commission if you choose to purchase through my links. This is at no extra cost to you! Read full disclosure here.

How to Use Your Printable Monthly Bill Organizer

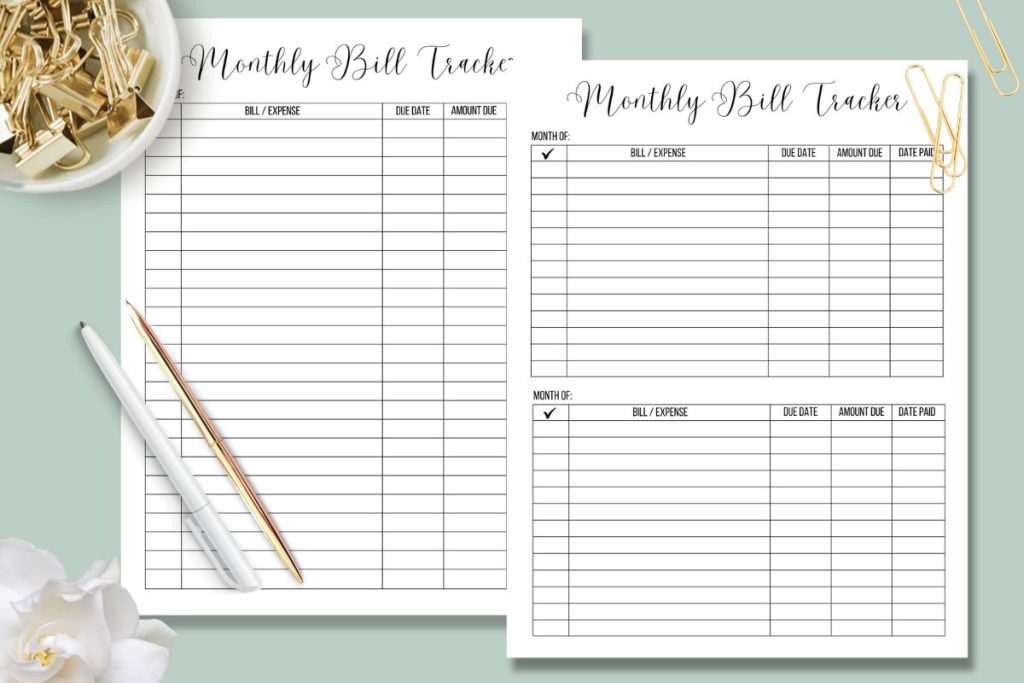

The free printable monthly bill trackers come in two formats – a full-page version and a split page version. The full-page version will be useful for those who have a lot of bills they need to keep track of. The half-page options have two months per page.

To start with, you’re going to want to create a list of bills and expenses (see below for more details on what all to list). Next to the name of the obligation, you can list out all of those crucial details.

Things like due date, total amount of the bill, and the date you paid it. Over on the other side of the page there is a box for a check mark. As you pay your bills, check it off of the list. This format will make it easy to see what’s paid and what’s due at a quick glance.

Want to create a Budget Binder? Be sure to check out these other free budgeting resources and practical tools I offer, like this Biweekly Paycheck Budget Printable.

What to Put on Your Bill Payment Log

Recurring Monthly Expenses

The first type of expenses you’ll want to list are those recurring monthly bills. These are usually things like your mortgage payments and utility bills. These amounts could be set or vary month to month. Either way, you have these bills every month and the due date is usually the same.

It’s up to you if you want to list out your automatic payments or not. I find that it’s a good way to follow-up, just in case there’s an issue with the transfer.

Annual Bills

Many people opt to pay certain bills on an annual basis, particularly car insurance or homeowners insurance premiums. If you have a lot of annual bills, it may be helpful to go ahead and set up logs for the whole year. You can write in annual expenses in their appropriate month based on due dates.

This is a great way to prepared for those future payments.

Irregular Bills

This category is going to be for bills that you don’t get on a regular basis. Things like credit cards you use occasionally or a medical bill that just came in.

Savings Goals

You can also input dates and amounts that you want to move money over to your savings account. Treating your savings account like another bill that is due it a great way to meet those financial goals!

If you need help finding out how much money you have left for a savings, you’ll need to make a monthly budget. An easy way to do that is to use some of the free budget planner pages I linked further up in this post. Or just search “budget” and you’ll see everything I offer.

Sinking Funds

Sinkings funds are funds set aside for a particular purpose. For example, if you have a vacation you’re planning to take, you can have a sinking fund for it. Or you can have sinking funds for those annual expenses, like property taxes.

Each month, you set aside a specific amount to go towards the total. Then when that amount comes due, you’ve already been saving for it for the entire year!

Get Your Printable Bill Trackers

Simply click the link below and the pdf files will open in a new window. Print as many copies as you need, just remember that these printables are for personal use only.

The bill payment logs are designed to fit on standard US letter paper size of 8.5″ X 11″.